Description

Accounting-Based Valuation Methods ... - University of Michigan

based on DCF methods, explain how the EBO formula can be implemented in . will ultimately drive the rate of return on new investment to the cost of capital, .

http://quod.lib.umich.edu/b/busadwp/images/b/2/0/b2014415.0001.001.pdfCorporate Strategy and Valuation – David Wessels - sifma

operating profit, return on capital, cost of capital (risk), and organic revenue growth. . Return on new investment. 10% . The Growing Perpetuity Formula .

http://www.sifma.org/events/2011/securities-industry-institute/presentations/year-3-core/david-wessels---corporate-strategy-and-valuation/EQUITY VALUATION USING DCF: A ... - Business Perspectives

According to the assets-side version of the DCF, the firm's value is calculated as . period and from the value of the incremental return on new invested capital .

http://businessperspectives.org/journals_free/imfi/2007/imfi_en_2007_01_Cassia.pdfReturn On New Invested Capital - What does RONIC stand for ...

(redirected from Return On New Invested Capital). 0.01 sec. Acronym, Definition. RONIC, Return On New Invested Capital. Want to thank TFD for its existence?

http://acronyms.thefreedictionary.com/Return+On+New+Invested+CapitalWhat is return on new invested capital (RONIC)? definition and ...

Definition of return on new invested capital (RONIC): A financial instrument . not be confused with Return on Invested Capital (ROIC), which involves calculation .

http://www.investorwords.com/18913/return_on_new_invested_capital_RONIC.htmlReturn On Invested Capital (ROIC) Definition | Investopedia

A calculation used to assess a company's efficiency at allocating the capital under its control to profitable . Return On New Invested Capital - RONIC .

http://www.investopedia.com/terms/r/returnoninvestmentcapital.asp

RPC, MOCON Have Limited Downside - Seeking Alpha

Mar 29, 2012 . As long as the return on new invested capital is greater than its weighted average cost of capital (~9%), this strategy will result in greater value .

http://seekingalpha.com/article/466911-rpc-mocon-have-limited-downside

Rate of return - Wikipedia, the free encyclopedia

The money invested may be referred to as the asset, capital, principal, or the cost . The rate of return can be calculated over a single period, or expressed as an .

http://en.wikipedia.org/wiki/Rate_of_returnReturn on Investment Analysis for E-business Projects Return on ...

When capital to invest is scarce new e-business . sary to understand and calculate ROI for e-business and . In addition, the limitations of calculating ROI, .

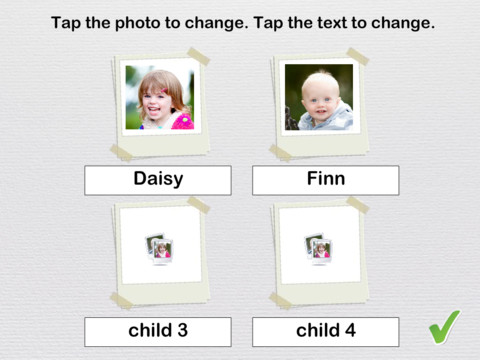

http://www.kellogg.northwestern.edu/faculty/jeffery/htm/publication/ROIforITProjects.pdfCustomize their name and photo

Navigating the challenges of Data Monetisation - Delta Partners

Specialisation and Smart ROIC (return on invested capital) Management. 3.1. Saturation. First, the . next growth wave. 10 |. * Return on New Invested Capital .

http://www.deltapartnersgroup.com/asset/download/739/Data_Monetisation_article.pdfTerminal Values - OpenLearningWorld.com

There are several approaches to calculating the terminal value: Dividend Growth: . tr: tax rate g: growth rate r: rate of return on new investments. Example 14 . NOPAT: Net Operating Profits After Taxes rc: return on invested capital. Terminal .

http://www.openlearningworld.com/books/Mergers%20&%20Acquisitions/Chapter%205/Terminal%20Values.html

Customer Reviews

added features are perfect

by

missSusieBoo

Value creation through M& A: - StudentTheses@cbs

May 4, 2009 . the calculated enterprise values is perfonned to identify the monetary effects of . Return On Invested Capital. Return On New Invested Capital .

http://studenttheses.cbs.dk/bitstream/handle/10417/743/grethe_simonsen.pdf?sequence=1

superb

by

Kingkenny2011

VALUATION OF FIRMS IN MERGERS AND ACQUISITIONS

Increase the return on new capital investment. . Calculating and Interpreting Results; Calculating And Testing The Results; Interpreting The Results Within The .

http://fic.wharton.upenn.edu/fic/cmbt/Okan%20Bayrak.ppt

really useful

by

Johnnybops

Falling Profits, Rising Profit Margins, and the ... - Brookings Institution

George Perry has calculated the dollar revenues of domestic oil producers quarterly . The price-cost relationships would generate (1) a return on new investment equal to the 1969 return on invested capital; and (2) a series of " capital gains" .

http://www.brookings.edu/~/media/Files/Programs/ES/BPEA/1975_2_bpea_papers/1975b_bpea_schultze.pdf